Crush your Series A pitch deck with these 10 sure fire slides

If you’re a founder with a new business concept, there’s a good chance you’re already working on a shiny pitch deck for your Series A funding.

If you’re a founder preparing for your Series A funding, you might be feeling a bit overwhelmed. The list of things you need to do is growing rapidly as you move through the fundraising process, and you might even start to feel like you’re in over your head.

Fundraising is often an intense experience for everyone involved, and as a founder, it can feel like the weight of the world is on your shoulders.

At times like this, it’s important to step back, assess your priorities, let go of some lower priorities, and focus your efforts on the key deliverables that will determine your success in closing the round.

So close your inbox for a few minutes and skim through the list below. We’ve boiled it all down to five critical assets that are essential to execute your fundraising plan, earn the trust of your target investors, and close that Series A round.

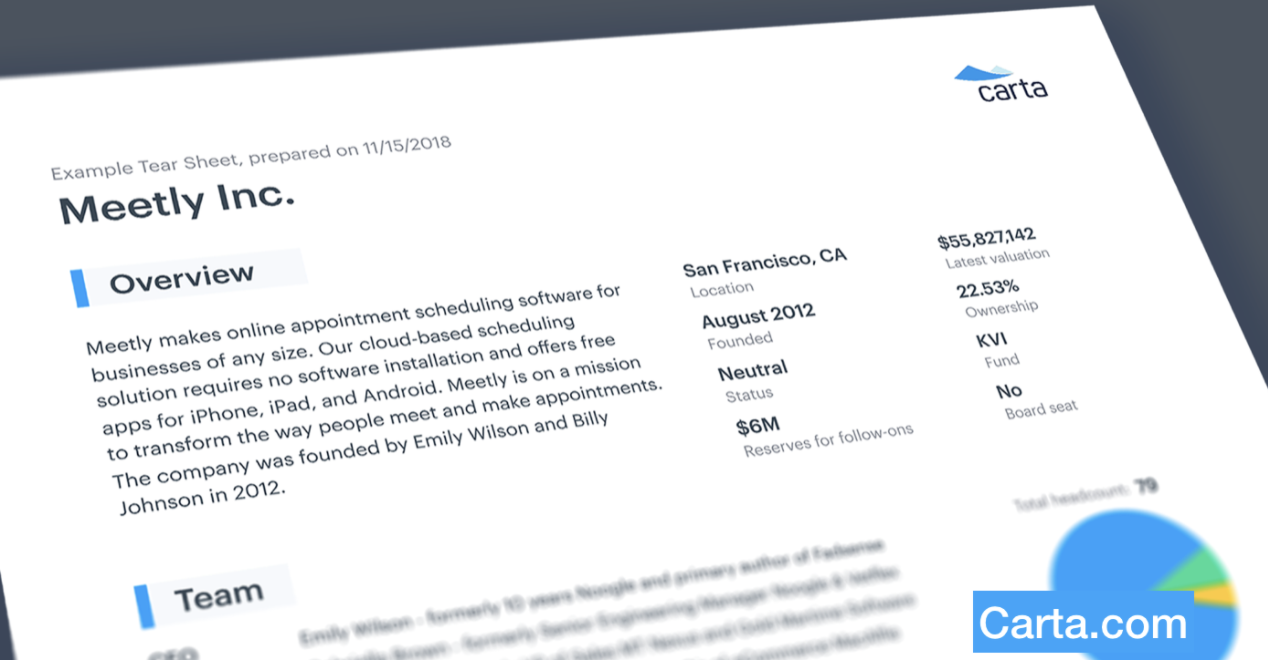

Purpose: Whet investor appetite and secure the next meeting

The tear sheet, sometimes called a fact sheet, should be a visually engaging document with high-level information on your company and team, with basic supporting data.

Your tear sheet serves as a teaser for your pitch deck, and should not reveal in-depth data or any information that might raise questions for the investor. Instead, this document should pique their interest and provide context for your pitch.

You should generally send your tear sheet by email following the initial introduction to the investor; ideally after discovery but before you walk them through your pitch deck.

Be conservative in what you share. Investors probably won’t send you away for providing too little information in your tear sheet. They expect you to provide some context for the big picture, and they know that the opportunity for questions and details will come later.

Purpose: Showcase your company and provide a brief overview

Much like your tear sheet, your pitch deck should be visually appealing and take a high-level approach. Your goal is to share the story of your company, the problem you are solving, and a very brief overview of your strategy and traction.

Investors should walk away from your pitch deck knowing who you are, what you do, and why you’re doing it.

Generally speaking, less is more in your Series A pitch deck. Investors have a short attention span and you need to capture it immediately. Within the first few slides, they should have a solid understanding of what your company does.

Here are 10 fundamental slides to use as a guide:

While your pitch deck should be short, it’s often part of your first in-person meeting with a Series A investor. As such, it’s critical to present well-designed slides that are perfectly polished. If you don’t have a graphic designer on your team, you should consider using a professional pitch deck service.

In addition to looking beautiful, your slides should also contain thoughtfully selected highlights from your available data. Give investors a reason to ask questions and continue the conversation.

The highlights you select should clearly show the work you have done so far, and the work you plan to do. But be careful not to reveal too much information at this stage. Your pitch deck is like an appetizer, and your financial model is the main course. A good deck will leave the investor asking questions that lead directly to your model.

Purpose: Showcase business potential and share growth plans

Your pitch deck engaged investors and got them to start asking questions. Your financial model gives them a window into the detailed operations of your business, including your financial statements, your performance metrics, and your growth strategy.

Most importantly, your financial model builds trust with investors. In their eyes, mastery of your financial model separates you from the amateurs. You don’t need to be a serial entrepreneur, but you do need a financial model that proves you understand exactly where your business stands and exactly how you plan to grow it.

Your financial model should clearly outline individual growth strategies for your company and define how you plan to measure success. To learn more, check this out: Financial Model 101: A Comprehensive Guide for Founders.

If you’re not a CFO, consider using a financial forecasting software like Forecastr to build a great financial model with a friendly user interface far better than anything you can build in Excel. You should be able to walk investors through your model to convey full transparency and provide in-depth insight into your growth assumptions.

Make sure your financial model is clean, well-polished, and always kept up-to-date. Know your financial model inside and out. If you show up with a model you don’t know how to use, investors will see right through it.

Purpose: Detail ownership of the company and show what investors are buying into

At this point in your Series A fundraising, investors have read your tear sheet, engaged with your pitch deck, and studied your financial model. They clearly understand who you are and how you plan to grow.

Now your investors need to understand in detail who owns what at each stage of the business. Your cap table charts your company’s securities, how much investors have paid for them, and a corresponding percentage of ownership in your company for all stakeholders.

Just like the previous three elements, you should ensure your cap table is clear and polished. Do not show investors a messy cap table. Excel can prove cumbersome to build with and risky to use as a source of truth. Consider using cap table management software to make the best impression on your investors.

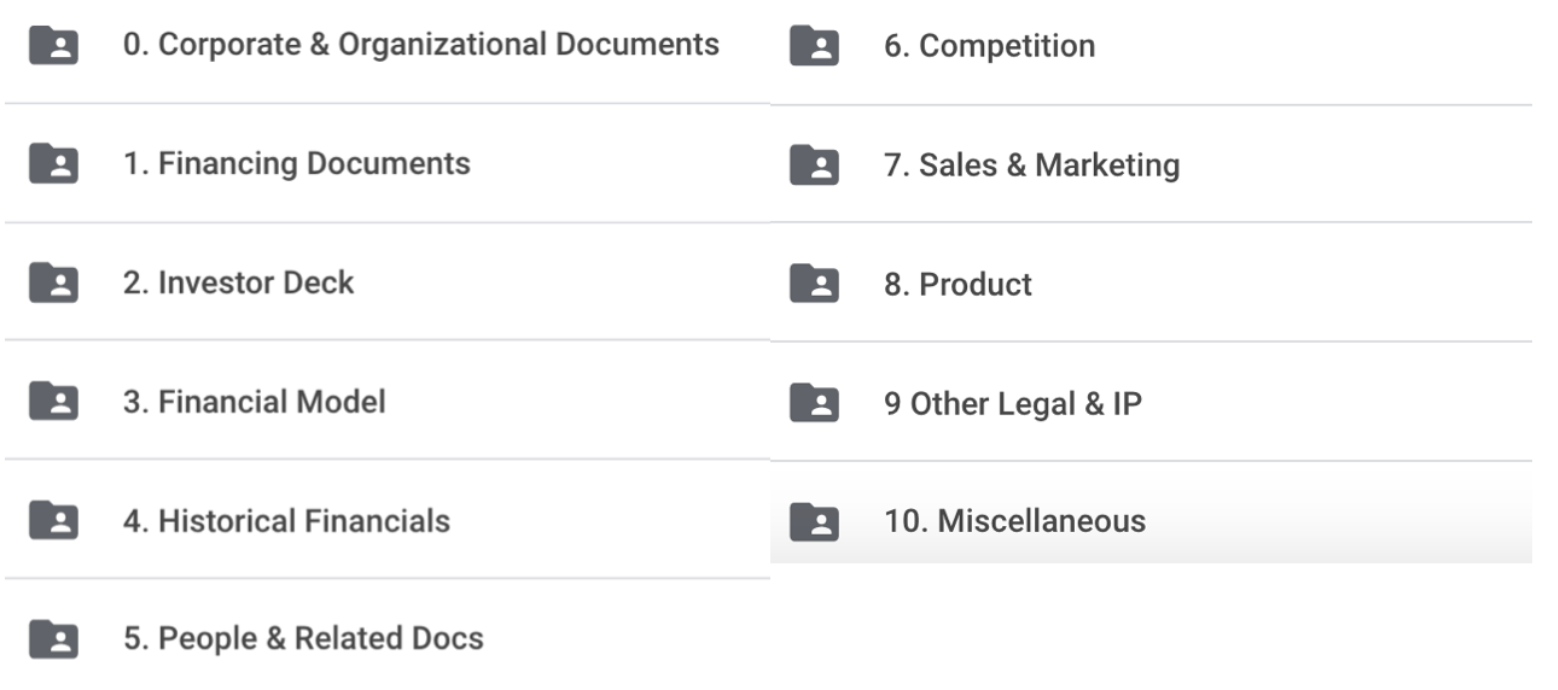

Purpose: Organize all documents and cut time on due diligence

When you reach the due diligence process in your Series A fundraising, you might receive hundreds or thousands of requests to view various company documents.

Investors might want to see employment agreements, customer contracts, invoices, statements, and much more. If you are not prepared for due diligence, this process can delay your fundraising for months as you collect and organize the documents your investors want to see.

To prevent delays, be proactive and organize all of your documentation in one shareable location so, when investors request information, you can simply send them a link and move on. Your data room can be hosted in Dropbox, Google Drive, or any other shared folder.

Label your folders clearly and organize them simply so a stranger can understand where to find each piece of information. Here’s a screenshot showing the organization of Forecastr’s data room:

When you manage your Series A fundraising well, each of these 5 assets transitions effortlessly into the next. Investors are left with the impression that you have excellent control of your operation and they can trust you to handle their investment with the same degree of precision.

Your fundraising process should walk them through a carefully planned journey – first piquing their interest, then providing a wealth of information, and finally closing the deal.

Your financial model is uniquely important because it informs each of the other assets in the list. If you need help building a financial model, reach out to Forecastr today. We offer a full-featured financial modeling tool, along with experienced analysts to help you make the most of it.

Get notified about new events, free resources, and fresh content

If you’re a founder with a new business concept, there’s a good chance you’re already working on a shiny pitch deck for your Series A funding.

So you’ve nailed down your business plan, you’ve got a solid proof of concept, or maybe even a working minimum viable product. You’re getting great...

As an early-stage founder, you know how difficult it can be to raise capital. Sometimes it feels like an impossible task. First, you fight tooth and...